Exploring the dynamics of Cash Offer vs. Mortgage: Best Way to Buy a Home in Georgia in 2026 sets the stage for a deep dive into the intricacies of real estate transactions. Brace yourself for an enlightening journey filled with valuable insights and practical advice.

Delve into the nuances of the real estate market in Georgia, uncovering the most effective strategies for homebuyers in the upcoming year.

Cash Offer vs. Mortgage

When buying a home in Georgia in 2026, there are two primary ways to finance the purchase: making a cash offer or obtaining a mortgage.

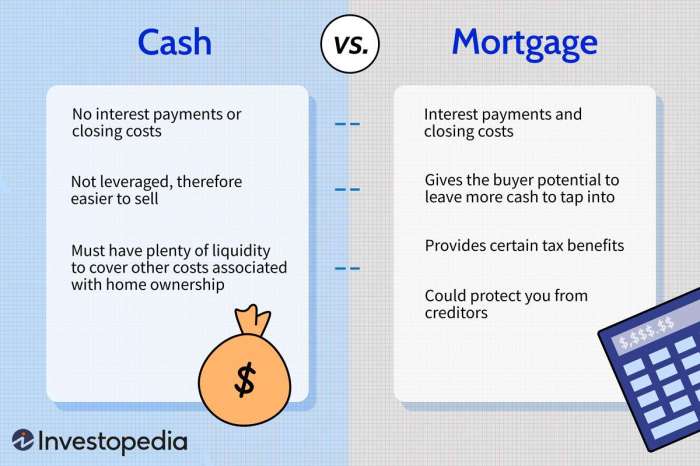

Cash Offer

A cash offer involves paying the full purchase price of the home upfront, without the need for a mortgage or any financing from a lender.

- Pros of making a cash offer:

- Quick transaction: Cash offers can often close faster than mortgage-financed deals, as there is no need for lender approval.

- Negotiation power: Sellers may prefer cash offers as they are less risky and can lead to smoother transactions.

- No interest: By paying in cash, you avoid paying interest on a loan, potentially saving you money in the long run.

- Cons of making a cash offer:

- Tie-up of funds: Tying up a large sum of money in a property purchase can limit your liquidity for other investments or emergencies.

- Missed investment opportunities: Using all your cash for a home purchase may mean missing out on other potentially lucrative investment opportunities.

Mortgage

Opting for a mortgage means borrowing money from a lender to finance the purchase of the home, with the property serving as collateral for the loan.

- Advantages of purchasing a home through a mortgage:

- Lower initial cost: With a mortgage, you can purchase a home with a lower initial cash outlay, spreading the cost over time.

- Investment diversification: By not tying up all your funds in a single property, you can diversify your investments and potentially earn higher returns.

- Tax benefits: Mortgage interest and property taxes are often tax-deductible, providing potential tax advantages for homeowners.

- Disadvantages of purchasing a home through a mortgage:

- Debt burden: Taking on a mortgage means committing to monthly payments, which can be a significant financial burden for some buyers.

- Interest costs: Over the life of the loan, you will pay additional interest on top of the principal amount borrowed, increasing the total cost of the home.

- Risk of foreclosure: If you are unable to make mortgage payments, there is a risk of foreclosure, which could lead to losing your home.

Current Real Estate Trends in Georgia

As of 2026, the real estate market in Georgia is experiencing significant trends and shifts that are shaping the way properties are bought and sold in the state.

Market Conditions in Georgia

The real estate market in Georgia is currently characterized by a high demand for housing, particularly in urban areas like Atlanta and Savannah. This demand is being driven by factors such as population growth, low mortgage rates, and a strong economy.

As a result, home prices have been steadily increasing, making it a competitive market for both buyers and sellers.

Factors Influencing the Housing Market

- The influx of new residents: Georgia has been attracting a large number of new residents, both from other states and internationally, leading to a surge in housing demand.

- Low inventory levels: The supply of homes on the market has been relatively low, further fueling competition among buyers and driving up prices.

- Economic growth: Georgia's robust economy, with diverse industries such as technology, film production, and logistics, has contributed to job creation and increased disposable income, making homeownership more accessible to many.

- Remote work trends: The rise of remote work has allowed more people to choose where they live, leading to increased interest in suburban and rural areas of Georgia.

Predictions for the Future of Real Estate

- Continued price appreciation: It is expected that home prices in Georgia will continue to rise, although at a slightly slower pace, as demand remains strong and inventory levels struggle to keep up.

- Shift towards affordable housing: With concerns about affordability becoming more prominent, there may be a shift towards the development of more affordable housing options to cater to a wider range of buyers.

- Investment opportunities: Real estate investment in Georgia, especially in up-and-coming areas, may present lucrative opportunities for those looking to grow their wealth through property ownership.

Financial Considerations for Homebuyers

When it comes to purchasing a home in Georgia, there are important financial considerations that homebuyers need to keep in mind. Whether opting for a cash offer or obtaining a mortgage, understanding the financial requirements is crucial for making an informed decision.

Financial Requirements for a Cash Offer in Georgia

- In Georgia, making a cash offer on a home means that you are paying the full purchase price upfront without the need for a mortgage loan.

- Homebuyers opting for a cash offer must have the total purchase price available in cash or liquid assets.

- Additionally, cash buyers may need to provide proof of funds to show that they have the necessary funds to complete the purchase.

Process of Obtaining a Mortgage for Buying a Home

- Obtaining a mortgage in Georgia involves applying for a loan from a financial institution to finance the purchase of a home.

- Homebuyers need to meet certain eligibility criteria, including credit score, income verification, and debt-to-income ratio, to qualify for a mortgage.

- Once approved, the lender will provide the homebuyer with a loan amount based on the purchase price of the home.

Costs Associated with a Cash Offer vs. Mortgage in Georgia

- With a cash offer, homebuyers can avoid costs such as loan origination fees, appraisal fees, and mortgage insurance premiums.

- On the other hand, homebuyers obtaining a mortgage will incur additional costs, including interest payments, closing costs, and possibly private mortgage insurance (PMI) if the down payment is less than 20%.

- It's essential for homebuyers to weigh the pros and cons of a cash offer versus a mortgage to determine which option aligns best with their financial situation and long-term goals.

Legal Aspects of Buying a Home in Georgia

When purchasing a home in Georgia, there are legal considerations that buyers need to be aware of to ensure a smooth and lawful transaction. Whether making a cash offer or obtaining a mortgage, understanding the legal implications is crucial to protect your interests and comply with state regulations.

Legal Implications of Making a Cash Offer

When making a cash offer on a home in Georgia, buyers should be aware of the legal implications of this transaction. One key aspect is ensuring that all necessary documentation is in place to prove the source of funds being used for the purchase.

This is to prevent any suspicion of money laundering or fraud, which can have serious legal consequences. Additionally, buyers should understand the risks involved in a cash transaction, such as the lack of financing contingencies that may be present in mortgage offers.

Legal Requirements for Obtaining a Mortgage in Georgia

Obtaining a mortgage in Georgia involves adhering to specific legal requirements set forth by the state. This includes providing detailed financial information to the lender, undergoing a credit check, and signing legal documents such as the promissory note and mortgage deed.

It is essential for buyers to fully understand the terms of the mortgage agreement and seek legal advice if needed to ensure compliance with state laws.

Specific Regulations or Laws Relevant to Homebuying in Georgia

Georgia has specific regulations and laws that govern the homebuying process to protect both buyers and sellers. For example, Georgia is a "buyer beware" state, meaning buyers are responsible for inspecting the property for any defects before purchase. Additionally, Georgia has laws related to property disclosure requirements, earnest money deposits, and foreclosure procedures that buyers need to be aware of to navigate the homebuying process successfully.

Prospective Homebuyer’s Guide in Georgia

Whether you are considering a cash offer or looking to secure a mortgage in Georgia, navigating the real estate market can be overwhelming. Here is a step-by-step guide and some valuable tips to help you make informed decisions as a homebuyer in Georgia.

Step-by-Step Guide for Homebuyers Considering a Cash Offer

- 1. Determine your budget: Calculate how much you can afford to spend on a home without straining your finances.

- 2. Research the market: Explore different neighborhoods and property types to find the right fit for your needs.

- 3. Get pre-approved for a mortgage: Even if you are considering a cash offer, having pre-approval can strengthen your bargaining position.

- 4. Make a competitive cash offer: Work with your real estate agent to make a strong cash offer that stands out to sellers.

- 5. Conduct a thorough inspection: Hire a professional inspector to assess the condition of the property before finalizing the purchase.

Tips and Advice for Individuals Looking to Secure a Mortgage in Georgia

- 1. Check your credit score: A higher credit score can help you qualify for better mortgage rates.

- 2. Compare mortgage options: Research different lenders and loan programs to find the best fit for your financial situation.

- 3. Save for a down payment: Aim to save at least 20% of the home's purchase price to avoid private mortgage insurance.

- 4. Get pre-approved: Submitting a pre-approval letter with your offer can demonstrate your seriousness to sellers.

- 5. Stay within your budget: Avoid overspending on a home and consider additional costs like property taxes and maintenance.

Insights on Navigating the Real Estate Market as a Homebuyer in Georgia

- 1. Work with a local real estate agent: An experienced agent can help you navigate the Georgia market and negotiate on your behalf.

- 2. Understand the local market trends: Stay informed about pricing, inventory, and competition in different neighborhoods.

- 3. Be prepared to act quickly: In a competitive market, being proactive and decisive can help you secure your dream home.

- 4. Consider future resale value: Think about the long-term potential of the property and its location before making a purchase.

- 5. Seek legal advice: Consult with a real estate attorney to ensure all legal aspects of the transaction are handled correctly.

End of Discussion

As we wrap up our exploration of Cash Offer vs. Mortgage: Best Way to Buy a Home in Georgia in 2026, remember that the key to a successful home purchase lies in understanding your options and making informed decisions. Armed with this knowledge, you're ready to navigate the real estate landscape with confidence.

Detailed FAQs

What are the advantages of opting for a cash offer when buying a home?

Cash offers usually result in a quicker transaction process and may give buyers an edge in competitive markets. However, it requires having the full purchase amount upfront.

What factors influence the housing market in Georgia in 2026?

Factors such as economic conditions, interest rates, and job growth play a significant role in shaping the real estate landscape in Georgia for the year.

What are the costs associated with obtaining a mortgage in Georgia?

Mortgage costs typically include down payments, closing costs, and interest payments over the loan term. It's crucial to factor in these expenses when considering a mortgage.