CRM Tools for Financial Planners and Consultants: A Comprehensive Guide

In the fast-paced world of financial planning and consulting, having the right tools at your disposal can make all the difference. CRM tools for financial planners and consultants play a crucial role in enhancing client relationships, streamlining communication, and boosting productivity.

Let's delve into the realm of CRM tools specifically tailored for the financial industry and explore their key features and benefits.

Overview of CRM tools for financial planners and consultants

CRM tools play a crucial role in the financial planning and consulting industry by helping professionals effectively manage client relationships, streamline communication, and enhance overall productivity.

Key Features of CRM tools for financial planners and consultants

- Centralized Client Information: CRM tools allow financial planners and consultants to store all client data in one place, making it easily accessible and organized.

- Task and Appointment Management: These tools help in scheduling appointments, setting reminders, and tracking tasks to ensure timely follow-ups with clients.

- Customizable Reporting: CRM tools offer customizable reporting features that enable professionals to analyze data, track performance, and make informed decisions.

- Automation of Processes: By automating repetitive tasks such as sending emails, updating client records, and generating reports, CRM tools help save time and increase efficiency.

Streamlining Client Communication and Relationship Management

CRM tools streamline client communication by providing a centralized platform for emails, calls, and messages, ensuring that all interactions are recorded and tracked. Moreover, these tools help in nurturing client relationships through personalized communication, targeted marketing campaigns, and timely follow-ups, ultimately leading to improved client satisfaction and retention.

Types of CRM tools suitable for financial planners and consultants

CRM tools play a crucial role in helping financial planners and consultants manage client relationships effectively. There are different types of CRM tools available in the market, each with its own set of features and benefits. Let's explore the various options suitable for financial professionals.

Cloud-based CRM tools

Cloud-based CRM tools are popular among financial planners and consultants due to their flexibility and accessibility. These tools are hosted on remote servers, allowing users to access information from anywhere with an internet connection. Examples of cloud-based CRM tools for financial professionals include Salesforce, HubSpot CRM, and Zoho CRM.

On-premise CRM tools

On-premise CRM tools are installed and managed on the organization's own servers and infrastructure. While these tools offer more control over data and customization options, they require a higher initial investment and ongoing maintenance. Popular on-premise CRM solutions for financial planners include Microsoft Dynamics CRM and SAP CRM.

Open-source CRM tools

Open-source CRM tools provide financial planners and consultants with the flexibility to customize the software according to their specific needs. These tools are cost-effective and allow for greater control over the system. Examples of open-source CRM tools tailored to the financial industry include SuiteCRM, SugarCRM, and Vtiger CRM.

Scalability and customization options

When choosing a CRM tool for financial planning and consulting, it is essential to consider the scalability and customization options offered by the software. Scalability ensures that the CRM tool can grow with the business and accommodate an increasing number of clients and data.

Customization options allow financial professionals to tailor the CRM system to their unique requirements, such as creating custom fields, workflows, and reports.Overall, the choice of CRM tool for financial planners and consultants depends on factors such as budget, business size, specific needs, and desired level of control over data and customization.

Each type of CRM tool has its own advantages and considerations, so it is important to evaluate the options carefully to select the most suitable solution for your practice.

Key functionalities of CRM tools for financial planners and consultants

CRM tools offer a range of functionalities that are essential for financial planners and consultants to effectively manage their client relationships and portfolios. These tools are designed to streamline processes, improve communication, and enhance overall client experience.

Client Interaction Tracking

- CRM tools allow financial planners and consultants to track all client interactions, including emails, calls, meetings, and notes, in one centralized location.

- By recording and analyzing these interactions, professionals can gain valuable insights into client preferences, needs, and behaviors.

- Tracking client interactions also helps in maintaining a personalized approach and building stronger relationships with clients.

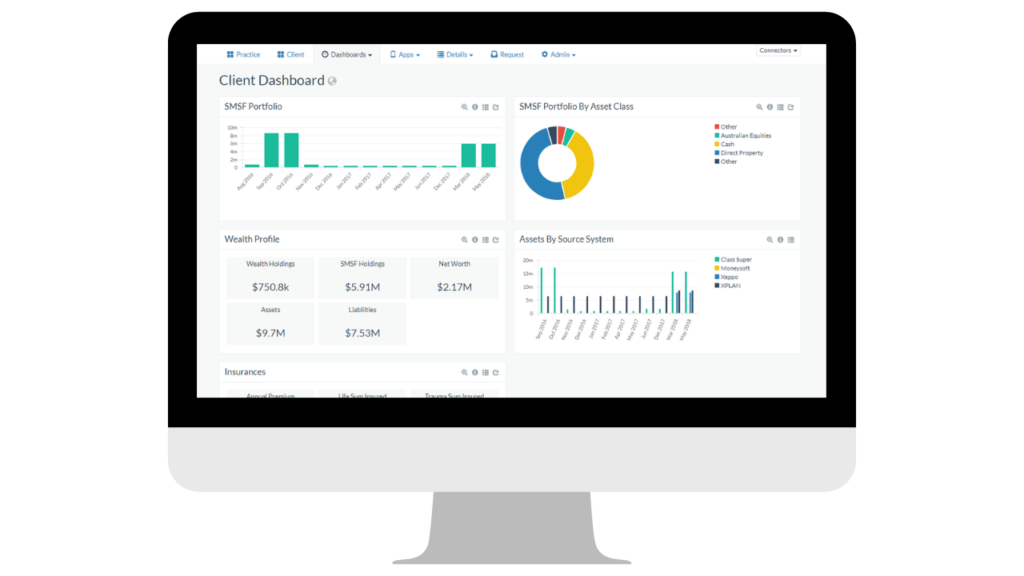

Portfolio Management

- CRM tools enable financial planners and consultants to manage client portfolios efficiently by organizing and updating investment information, performance reports, and financial goals.

- These tools provide real-time data on client portfolios, allowing professionals to make informed decisions and recommendations based on the latest information.

- Portfolio management functionalities help in monitoring client investments, rebalancing portfolios, and ensuring compliance with regulations.

Appointment Scheduling

- CRM tools offer features for scheduling appointments, setting reminders, and sending notifications to clients, reducing the chances of missed meetings or deadlines.

- Professionals can easily view their calendar, check availability, and book appointments with clients, streamlining the scheduling process.

- Automated appointment reminders help in improving client engagement and ensuring timely follow-ups on action items discussed during meetings.

Integration Capabilities

- CRM tools have integration capabilities with other financial software and applications, such as accounting systems, financial planning tools, and document management platforms.

- Integration allows for seamless data transfer between different systems, eliminating manual data entry and reducing errors.

- By integrating CRM tools with other software, financial planners and consultants can create a cohesive ecosystem that enhances productivity and collaboration across various functions.

Benefits of using CRM tools for financial planners and consultants

Using CRM tools can bring various advantages to financial planners and consultants, enhancing their operations and client relationships.

Improving client retention and acquisition

- CRM tools help in tracking client interactions, preferences, and feedback, allowing for personalized and targeted communication.

- By analyzing client data, financial planners can identify opportunities for cross-selling or upselling, leading to increased client retention and revenue.

- Automated reminders and follow-up features in CRM tools ensure timely responses to client inquiries, enhancing customer satisfaction.

Enhancing productivity and efficiency

- Centralized client information in CRM tools streamlines data management and eliminates the need for manual record-keeping, saving time and reducing errors.

- Automated workflows and task assignments help in prioritizing client service activities, improving overall efficiency in daily operations.

- Integration with other tools and platforms simplifies data entry and ensures consistency across different systems, enhancing productivity.

Complying with regulatory requirements and data security measures

- CRM tools provide features for tracking client consent, managing opt-ins and opt-outs, ensuring compliance with data privacy regulations.

- Secure data storage and encryption in CRM tools protect sensitive client information from unauthorized access, maintaining data security.

- Audit trails and reporting capabilities in CRM tools enable financial planners to demonstrate compliance with regulatory requirements during audits or inspections.

Closing Notes

As we come to the end of our discussion on CRM tools for financial planners and consultants, it's evident that these tools are indispensable for modern financial professionals. From improving client retention to ensuring regulatory compliance, CRM tools offer a myriad of advantages.

Embrace the power of technology and take your financial planning and consulting services to new heights with the right CRM tools by your side.

Key Questions Answered

What key features make CRM tools essential for financial planners and consultants?

CRM tools offer functionalities like client interaction tracking, portfolio management, and appointment scheduling, crucial for efficient client management in the financial industry.

How do CRM tools help in complying with regulatory requirements?

CRM tools play a vital role in ensuring data security measures are met and assist in adhering to regulatory requirements in the financial sector.

What are the different types of CRM tools available for financial planners and consultants?

Financial planners and consultants can choose from cloud-based, on-premise, or open-source CRM tools, each offering unique advantages based on individual needs.